Many landscape companies focus on growing revenue. Depending on who owns your company and its current size, there may be a better focus.

Selectivity can be a powerful option for companies not forced by circumstances to show high revenue growth.

I use the bottom line, specifically the operating profit margin, as a measure for:

- The life margin of the owner. The life margin is the owner’s excess time and energy no longer a required investment in the company.

- The company’s customer satisfaction.

- The effectiveness of management.

- The efficiency of operations.

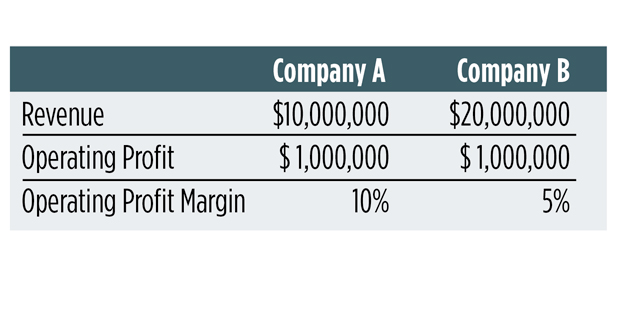

Operating profit is revenue less direct and overhead expenses, including depreciation and reasonable owners’ compensation. The operating profit margin is a percentage calculated by dividing operating profit by revenue.

Using the power of selectivity, companies can focus on optimizing the operating profit margin. In The Herring Group’s Landscape Industry Benchmark Report, we routinely see a $10 million company making the same operating profit in terms of dollars as a $20 million company. That means that the $10 million company’s operating profit margin is twice that of the $20 million company, as seen in the table below.

How selectivity applies to your business

As an owner, which company would you rather operate? A smaller company that needs fewer employees and has greater simplicity yet produces the same operating profit.

A more profitable company has more flexibility to acquire other companies, sell at a greater price, experiment with creative incentive plans to retain valued employees and endure recessions (remember those?).

Selectivity is an opportunity for companies to be more precise about the services offered and the types of customers or projects pursued. Assuming companies have good data, the power of selectivity allows the company to choose more profitable services with higher profit margin customers. These companies let competitors perform less profitable services for lower profit margin customers.

Putting selectivity to work

When The Herring Group works with clients who perform maintenance services, we review each customer’s profitability and budget performance for the previous year. While our analysis is more sophisticated, an easy way for your company to use the power of selectivity is to:

- Calculate the gross margins of the green contract, the snow contract and any additional work performed, as well as the overall gross margin for each customer.

- Identify the most profitable and least profitable customers.

Companies can be more selective in two ways: First, more aggressive in raising prices for the least profitable customers, and second, more selective in the future by pursuing only the opportunities that share the characteristics of the most profitable customers.

For companies with construction projects, The Herring Group analyzes yearly the profitability and budget performance of each project. This analysis is just as valuable as the analysis of maintenance customers, but it is usually more complicated because of significant variations in labor, materials, equipment and subcontractor costs. The focus is on identifying the project and customer types that enable the company to optimize the operating profit margin.

If done correctly, these reviews will consume many hours, but the return on that investment can be significant. Having data that people trust and reports that make it easy to see clearly will speed up the review and increase the return time invested — increasing your operating profit margin. This process also will increase the owner’s life margin because account managers, production managers and project managers perform these tasks with minimal leadership from the owner.