As landscape contractors and lawn care operators flip their calendars to a new year, most are doing so with smiles on their faces.

That’s because whether those folks are looking back at their business’ performance in 2024 or looking ahead to what 2025 might have to offer, there is a sense of overall optimism about where the industry is and where it’s headed, at least according to the results of Landscape Management’s 2024 State of the Industry Report.

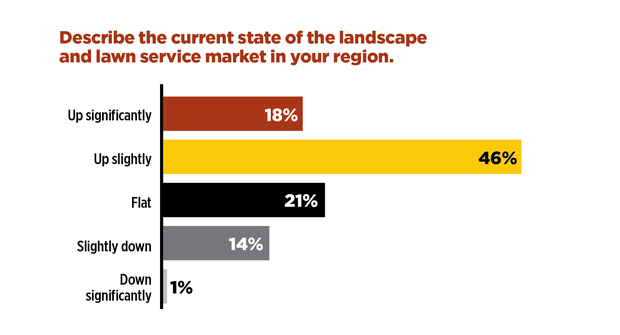

Despite some challenges, more than 60 percent of respondents to the magazine’s annual survey said that the landscape and lawn care market in their region moved in the right direction in the year that just concluded — and nearly 20 percent of those said their local markets were up significantly.

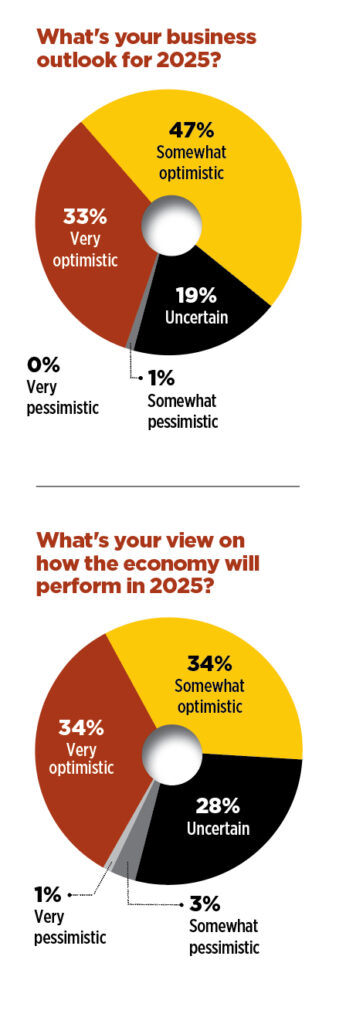

That positivity only increased when they were asked about their outlook for 2025. Over 80 percent of readers said they were either very optimistic or slightly optimistic about what this year promised for their businesses. They cited everything from macro issues like a stable national economy to more micro reasons, such as strong customer retention efforts, for their bullish outlook.

Only a single respondent to LM’s survey indicated they were pessimistic about 2025.

In the coming pages, we’ll explore the results of our State of the Industry Report more deeply. We’ll also share insights from business owners, suppliers and other observers to learn why most are so optimistic about the industry’s overall direction and what challenges they’re monitoring that might potentially dampen those good feelings.

Taking stock of 2024

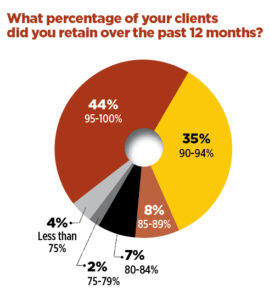

Most landscape company officials that LM spoke with shared the sentiments of survey respondents about 2024, saying the previous 12 months continued trends from the last two post-COVID years of slow, steady growth in both customer bases and overall revenue. And even though a few admitted to some tough sledding during the year, they still found plenty of positives in 2024 in terms of setting up their operations for future success.

Count Nate Moses in that group. The founder and CEO of Precision Landscape Management in Greenville, S.C., Moses characterized 2024 as a net positive for his company, even though Precision missed out on its annual revenue goal.

“Our revenue growth was not quite what we expected it to be,” Moses says. “We still managed to make a decent net profit, and I’d say 2024 was a good year for us. But we fell short of our initial annual budget. “More than anything, though, we really wanted 2024 to be a maturing year for us, a year for us to focus on our processes, focus on our people and mature as an organization. We experienced a lot of growth before the pandemic and then again in 2022 and 2023, so we really wanted to get the company on solid footing and prepare for future years of growth. We had the opportunity to do that (in 2024), so I feel good about where we are starting the new year.”

Moses says he heard similar stories about 2024 from his industry colleagues in South Carolina and those he engages with in various peer groups to which he belongs.

“I think some companies might have been a little bit ahead of us, a little more prepared for growth, so I know there were some companies that did big numbers in 2024,” he says. “But I think there was a general sense that the economy and inflation would impact business last year. I heard quite a few say that inflation impacted homeowners and clients, so they weren’t expecting a whole lot of growth and focused on other aspects of their business.”

Nolan Gore, general manager and owner of Top Choice Lawn Care in Austin, Texas — Gore and members of his team are featured on the cover of this issue of LM — said that while 2024 presented challenges for his growing business, he’ll remember the year fondly.

“2024 was a hard year for our team,” he says. “We worked like hell. We executed well. In the end, it was still really tough, but I thought we proved that we have some grit and resiliency, and I am hopeful for 2025.”

The manufacturing side of the business had a similar story to tell in 2024. Shane Coates, vice president of dealer sales at JCB North America, an equipment manufacturer specializing in compact equipment in the landscaping space, described last year as a “challenging” one that still yielded positive results for the company, thanks in large part to customers in the landscape industry.

“The landscaping segment was the most favorable industry segment in 2024 and showed remarkable resilience,” Coates says. “That sector maintained steady demand as homeowners and commercial property owners continued to invest in outdoor spaces that enhance functionality and aesthetics.”

A crystal ball for 2025

For some, the positive vibes surrounding the coming year in the landscape business are just that — hints, feelings or even wishful thinking about what’s to come. For others, such as Stuart Rinehart, founder and president of Aloha Aina Landscaping in Waimanalo, Hawaii, those vibes are more of a complete confidence.

“2025 is going to be a great year. I’m 100-percent certain of it financially,” he says. “My mindset for 2025 is to be one of the best givers and to serve our clients, and specifically my employees, as best as I can. Because of that, I’m 100-percent certain that 2025 is going to be an amazing year.”

Others share Rinehart’s bright outlook for this year. Mark Bradley, founder of LeanScaper based in Toronto, says all signs he sees are pointing up, whether those are economic projections or conversations with landscape professionals throughout North America.

“I think (2025) is looking great. The results of the election have certainly put some steam in people’s pocketbooks. I’m hearing a lot of good things already,” Bradley says. “The economic forecasts I follow are looking pretty solid from 2025 to 2028. I’m pretty confident that the market is really going to bounce back this year.”

The picture in north-central Indiana is similarly bright, according to Brian Hoffman, CEO of Hoffman’s Nursery and Landscaping in Wabash, Ind. He says that after settling into a “new normal” in 2024 following the COVID years, “we think this year is going to be a good one.”

“I feel like there’s a lot of positive energy. For us, I know that our phones started ringing after the election. In an election year, no matter what way it goes, I feel like people are hesitant about any sort of expenditures. But we’re looking forward to a good 2025, and everything I see out there is positive,” Hoffman says.

Gore’s view from South Texas is similar. “I see the year as a big one for our organization,” he says. “I do not expect it to be an explosive growth year or monumentally profitable, though I think we will see some good progress there. But I do expect it to be a year of gathering strength financially, solidifying operational excellence and enjoying some

camaraderie with the team.”

Lynn Tootle, managing partner at Gro-Masters in Garden City, Ga., is as excited about the prospects for the coming year as anyone. But in his case, it’s an excitement born from recent successes and expansions as much as from broader industry optimism.

“Since COVID, we’ve been in an unprecedented growth mode,” Tootle says. “Being able to continue to support that growth in our existing markets while focusing on outward expansion is going to be a real focus for us in 2025. We’re going to focus on further establishing ourselves in our new markets (Myrtle Beach is the most recent) while looking at opportunities that might be out there in other markets — just a constant eye on growth.”

“Managing growth … taxes people, and it taxes resources. Each time we’ve gone into a new location, we’ve made mistakes. The key is that we learn from those mistakes. So, for us,

the big challenge is how do we continue to grow the way we want to without ever sacrificing how we serve our customers and how we take care of our employees?”

Marty Grunder, president and CEO of Grunder Landscaping Co. and The Grow Group in Dayton, Ohio, and a monthly columnist for LM, says the air of optimism surrounding this year — whatever its source — is well-founded.

“I’m super excited about the economy,” Grunder says. “I don’t like making political comments, but I do think Trump is probably a more business-friendly president. I think that’s going to give more of the money that’s been sitting on the sidelines a chance to be spent. There will be issues — there always are — but I’m very, very bullish on 2025.”

Hurdles to clear

Those LM spoke to for this story weren’t all sunshine and roses, of course. They admit that 2025 is almost certain to present challenges to landscape contractors and lawn care operators that will require attention if those promising predictions about the year are to become a reality.

That’s why Precision’s Moses is taking a cautiously optimistic approach to the next 12 months. “My thought is, ‘Hey, let’s expect some growth, but let’s also have a plan if we fall short of our goal,’” he says. “But I think it’s safe to expect a return to some growth, especially where we’re located. There is lots of interest in living in the Southeast, and plenty of people are moving here, so the market for the services that we provide is strong and is going to stay strong.”

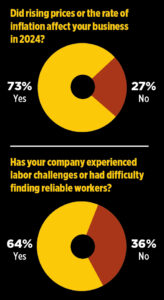

Among the potential trials and tribulations that could face the industry in 2025 are rising costs and inflation, regulatory pressures and labor and staffing issues, all commonly cited by respondents to the State of the Industry survey as hurdles that will need to be cleared this year. Not surprisingly, labor topped that list — 64 percent of respondents indicated they had experienced labor challenges or had difficulty finding reliable workers.

Grunder doesn’t sugarcoat the problems that labor shortages could pose. “I think the big problem will continue to be trying to find capable help that we can staff our companies with,” Grunder says. “The current American workforce … it’s very tough to find people who want to do this work.”

LeanScaper’s Bradley agrees, saying the industry’s staffing issue is largely one of supply and demand — too much work and not enough people to do it. “I think moving forward, we’re going to see a much bigger demand for our services than we’ve seen in the last 18 months or so,” he says. “That’s going to result in contractors suffering from a workforce shortage, as opposed to a work shortage.”

On the regulatory front, 40 percent of survey respondents said pressures at either the national or state level were affecting their business and the industry. In New England, those pressures have been most notable when it comes to pesticides, fertilizers and other specialty products, says Edward Coady, CEO of Mainely Grass, which serves customers in both New Hampshire and Maine from its headquarters in Bedford, N.H.

“The state of Maine is quite ambitious in its pesticide regulatory goals, so there’s a lot of regulations in the state,” Coady says. “But individual towns are restricting pesticides further because they have pre-exemption rights and can do that. It’s a concerning trend.

“The piece that’s really challenging … is that the discussions about pesticides are often not collaborative. Some folks either don’t want lawns to exist or want them to exist in a very restrictive way, regardless of how much great work has been done to test products or how environmentally aware and

friendly we are as applicators.

“I’m certainly bullish about the long-term trends in the industry. But we need to make some progress in finding a more informed consensus going forward, a more thoughtful place.”

But if one industry is well-positioned to meet and overcome those challenges, Grunder believes it’s landscaping.

“We offer something that people love. It’s outside. There continues to be a love for the environment … and I still think the green industry is the most environmentally correct industry in the country,” he says. “It’s a great business, and there continues to be tons of opportunity for us to exploit our talents and leverage them accordingly. There is no reason to be anything other than bullish (on the industry’s future).”

Inside the numbers

Those readers participating in LM’s 2024 State of the Industry survey represented every region of the country, with the Northeast (34 percent) and Midwest (27 percent)

accounting for half of the total responses.

The companies those respondents worked for came in varying shapes and sizes. A full 60 percent of the companies had less than 20 employees, while on the flip side, nearly 15 percent of respondents were from companies with teams of 100 employees or more. Services offered by those companies included mowing and maintenance (79 percent); weed, disease, insect control and fertilizer applications (65 percent); hardscapes (64 percent); design, build and construction (62 percent); and irrigation (59 percent). Thirty-eight percent described their companies as “full service.”

In addition to gauging general opinions about 2025, the survey also asked specific questions focused on business management topics, such as purchasing strategies, company

expansion plans, regulatory concerns and thoughts on mergers and acquisitions.

Blue Griffin Marketing)

Of note from those lines of questions, 78 percent said they planned to add equipment to their fleets in 2025, mainly trucks and trailers (81 percent), handheld equipment (68 percent) and mowers (62 percent).

And an increasing number of those looking to buy in 2025 will be at least exploring battery-powered equipment and autonomous units. Thirty-three percent of respondents said battery-powered equipment would be on their shopping list, while 21 percent said they would consider robotic options when the time comes.

When it comes to the growing number of mergers and acquisitions in the landscape industry and the role private equity plays in those moves, readers expressed a growing openness to that process. Just more than half said they had been approached about selling their businesses in 2024, and a similar number said they would entertain offers from private equity if they were to come in 2025 and beyond. For more on mergers and acquisitions, see “Forecasting the future of mergers and acquisitions” on page 26.

A strong foundation

Regardless of what the coming year ultimately delivers for those in the landscaping industry, most of the professionals LM spoke to for this story said their overall thoughts about the business that they have chosen would remain unchanged. They’ve found a career they love and look forward to whatever the future might hold.

“Things are looking strong and getting stronger,” says Terry Weaver, general manager of Think Green Lawn Service in Cumming, Ga. “People don’t have as much time as they used to have, so things like landscaping and lawn care are things they either don’t have time to do anymore or just don’t want to do anymore. They’d rather hire someone to do that for them, so as long as that trend continues, I think the business is going to be strong.”

Top Choice’s Gore put it this way: “I love this industry, and I love the people in it. It’s a hard business, but it’s good and honorable. More than ever, this is a scrappy industry with grit. The technology shifts and labor troubles will be hard. But people in this industry expect hard and handle it better than most. “Because of that … bring it on. I feel great about our future.”