The Green Industry benefits as residential customers become more comfortable with their finances.

Green Industry companies that serve the residential market are upbeat about the direction they see this portion of the industry headed.

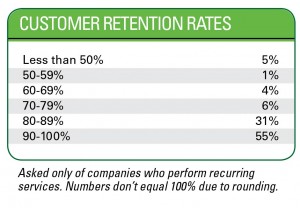

On the recurring services side, Andrew Ziehler, owner of Ziehler Lawn & Tree Care in Centerville, Ohio, says, “Spending is picking up with customers.”

In his area, he says, the improvement has been gradual. He attributes it to consumer confidence and people “feeling more comfortable” with the economy.

Ziehler’s assessment is correct: In August, the Thomson Reuters/University of Michigan’s Index of Consumer Sentiment ranked at 82.1, up from 74.3 for the same period in 2012. The index averaged 69.85 from 2008 until 2013, reaching an all time high of 82.7 in November 2012. The record low of 55.3 occurred in November of 2008.

Ziehler’s primarily residential company is 65 percent lawn care and 35 percent maintenance. He expects to end the year with annual revenue of $1.2 million, a 40 percent increase over 2012.

On the design/build side, Diana Grundeen says clients are willing to invest in their spaces again and invest “bigger dollars” than they have been in recent years.

Landscape Management Industry Pulse research reveals average prices and project levels for residential services are all up in 2013 over 2012 (see charts).

“(Clients) understand it’s an investment in their property and they’re willing to put money into it,” says Grundeen, landscape designer/owner of Trio Landscaping, a Minneapolis-based design and project management firm that subcontracts with about five installation contractors.

The unemployment rate may have something to do with better market conditions, she suspects. Nationally, it’s at 7.3 percent, its lowest rate since December 2008. In Minnesota where Grundeen operates it’s about two points lower. When people are working more, they have less time to tend to their landscapes, she says. Also, as customers and potential customers aren’t “fearful of pink skips right now,” it makes them more willing to spend.

“When customers are not afraid of losing their jobs, it makes it a whole lot easier to dump a few thousand into their landscapes,” she says. Trio Landscaping had a bit of a slow start to the year due to a late spring. The company will do about $438,000 in revenue this year and Grundeen is budgeting $450,000 next year.

Still some hesitation

Bill Banford of The Sharper Cut in Upper Marlboro, Md., says his business never took much of a hit during the recession because of its proximity to Washington D.C. and his many clients who have stable employment with the government. Still, the deflated housing market has caused remodels to take precedence over new builds.

“Because of the economy, people are deciding not to move and just stay at home and improve their houses, whether it’s inside or outside,” says the president of the primarily residential design/build company that has grown about 80 percent this year to $2 million in revenue. “It has affected us more so by clients deciding to save more,” and that may mean doing projects in phases vs. all at once, he adds.

Tom Canete, owner of Canete Landscape and Canete Snow Management in Wayne, N.J., agrees residential design/build has been somewhat of a tougher sell recently than in the past.

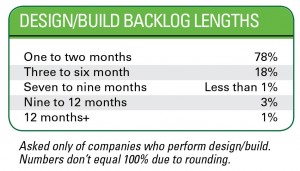

“In the early 2000s, we were able to tell people we were booked for two to three months and they’ve give us a deposit and get on the schedule,” he says. “Now, because of the competition, you can’t tell them that. You have to find ways to get that work done.”

One strategy, he says, is splitting up crews to spread out experienced, skilled workers among laborers, so they can be on more jobs. This tactic and others are working: Canete, who employs about 75 workers on the landscape side of his business, plans to be up 25 percent to 35 percent this year over last year in his mostly residential design/build division.

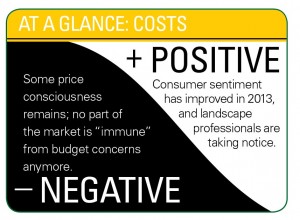

Consultant Bruce Wilson of the Wilson-Oyler Group reports the very high end of the residential market is seeing some price sensitivity.

“I think it’s an outcome of the recession that people in general have become more price conscious,” he says. “It used to be the higher-end residential market was somewhat immune to pricing issues, but now they’re much more price conscious.”

Additional reporting by Sarah Pfledderer.