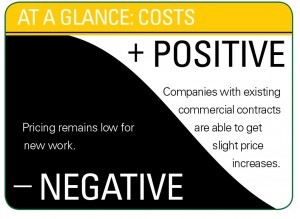

Pricing is still a concern on the commercial side of the business, but the tide may be starting to turn.

Landscape professionals on the commercial side of the business say they’re seeing some clients return to a quality- and value-driven mindset. That’s good news for these companies, as many of them may be doing some work for less than they were before the recession, even though many costs have risen year after year.

Green Industry consultant Bruce Wilson of the Wilson-Oyler Group differentiates clients’ willingness to pay more by whether the work is new or existing.

“If you’re trying to get a new job, bidding is low, but contractors who have work are able to get price increases from their customers, which they weren’t a few years ago,” he says.

Existing customers are open to price increases because they’re aware costs rise and contractors likely haven’t had an increase in three to four years, Wilson says.

“If you have work, you’re probably doing it for less than you were five years ago because unless you lowered your price, the customer was going to take the low bid, so you had to match that,” he says.

Todd Pugh, CEO of $11.5 million Todd’s Enviroscapes in Louisville, Ohio, puts a face to this statement. “The reality of it is we’re forced to charge 15 percent less than we did 10 years ago, and our inputs are double,” he says. “Because many of us have survived that, the sad part about it is how much money did we lose all those years before when we weren’t lean? We’re so efficient now. You have to be a good businessperson to be profitable today. The days of just doing a good job cutting grass are long gone.”

Getting an increase

Wilson pegs commercial price increases this year in the 3 percent to 5 percent range. Landscape Management Industry Pulse research shows commercial maintenance contractors’ average price per visit increased 7 percent from 2012 to 2013. Commercial prices for design/build projects, lawn care applications and irrigation maintenance all rose, too (see chart, “Price Tags: Commercial Services”).

In Florida, Jeff Bowen says he raised prices on large contracts by 2 percent, though he hasn’t raised prices on the residential side but expects that may have to change next year if minimum wage requirements increase. Bowen is the owner of Images of Green, a $1.8 million full-service company in Stuart, Fla., that has a client base of about 30 percent commercial customers (HOAs) and 70 percent residential customers. He doesn’t want to be the lowest-priced business in his market, he says, but it’s a balance to prove the company’s value to clients before expecting an increase.

Matt Owens, vice president of landscape operations for Potomac Garden Center in Urbana, Md., also has witnessed clients who are open to paying for quality. “I’m seeing the shift from the price-conscious decision-making mentality back to the quality side of the pendulum,” he says. “That bodes well in our favor. We’re not trying to be the low-cost provider, yet we’re forced to compete with national firms in our market.”

His company’s landscape division does just north of $2 million in annual revenue; most of its business comes from the homeowners association (HOA) market. He calls the landscape market overall “strengthening to very strong,” compared to 2008. “It’s nothing like it was in 2004 through 2006,” he says. “But if things keep increasing like they have been over the last year and a half, we could get back in that neighborhood.”

Bidding wars subside

Competing on price with national landscape firms may be less of a concern, Wilson says, noting he’s heard The Brickman Group and ValleyCrest Cos. “are not bidding as low as they once were.”

More good news: Some say commercial clients are going out to bid less frequently.

“If you can keep the customer happy, they’re not going to go out to bid; in fact, they’re going to give you a price increase,” Wilson says. “Some customers think if they go out to bid their prices will go up. Others say they’ve been burned by low bids, so if they’re happy they’ll stay.”

Owens agrees. “For the most part, going out to bid isn’t a concern,” he says. “We have one large community that puts it out to bid every three years. That’s their M.O., even when there’s no level of dissatisfaction, but in general, it’s not a concern.”

Even so, Owens has focused on lengthening commercial contracts since he joined the company in 2010. “Every contract was one year,” he says. “Thirty to 40 percent now are three years. One contract is now five years. There is some risk to that from a labor and fuel standpoint, but it’s a very nice community in our staple area. We want to work with them and build our nucleus there.”

Potomac’s landscape division, which grew 23 percent alone in its base commercial maintenance revenue in 2013 over 2012, plans to grow about 10 percent to 15 percent in base maintenance next year, too. “Everything else—tree care, enhancements—is extra and extremely profitable,” Owens says, adding his company’s position, with two garden centers, gives it a unique selling point. No. 1, the landscape division’s goal is to saturate the area within a 5-mile radius of one of the garden center locations to improve profitability. And secondly, it provides a community discount program for the residents who are part of the HOAs it maintains, giving these customers 20 percent off all materials purchases.

“The intent is to have the homeowners receive the highest quality products and plants—the same thing the boards are hiring us for to keep the common grounds looking great,” he says of the seven-year-old program that services up to 7,000 individual homeowners.

Additional reporting by Sarah Pfledderer.