This year’s list has a first—two companies topping the billion-dollar mark.

For the first time ever, there were two landscape industry companies with more than $1 billion in annual revenue. Topping the LM150 list are BrightView at $2.2 billion and TruGreen at $1.3 billion.

There has been significant consolidation over the past few years. Four out of the top five firms from our 2014 list are now two companies (Brickman Group/ValleyCrest Cos. became BrightView and TruGreen has absorbed Scotts LawnService).

These top two firms account for more than a third of the total revenue generated by companies on the LM150 list. Still, it remains a fragmented industry. By most estimates, the companies on this list make up just 1 percent or less of the companies in the market.

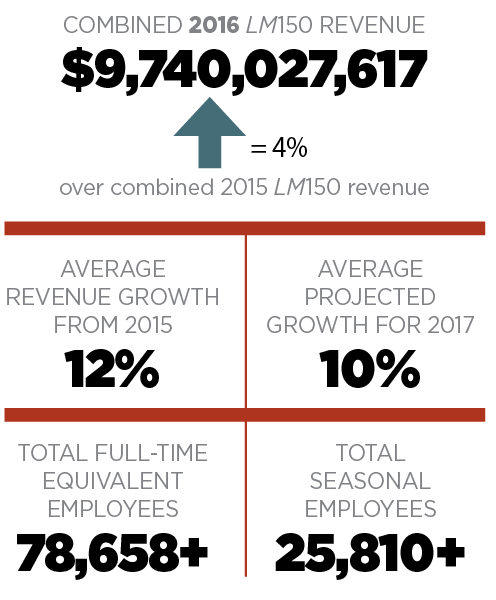

LM150 firms are quickly approaching $10 billion in combined annual revenue. They grew an average of 12 percent over 2015 and they expect to grow 10 percent this year. Altogether, they employ more than 100,000 year-round and seasonal employees.

Growth appears to have slowed a bit from the last two lists when companies reported an average of 16 percent growth year over year. But it’s also true that several companies didn’t participate in this year’s list for strategic reasons, like a desire to lay low during pending sales or rebranding efforts.

It’s important to mention these data are self-reported unless otherwise noted. Some companies, such as Davey Tree Expert Co., don’t break out their service lines, so we don’t know what revenue is specific to landscape services. Additionally, we have no doubt overlooked some companies, and it’s possible some revenue overlaps due to subcontracting agreements among companies on the list.

To see how the participants rank, turn back a page and open the gatefold for the LM150 listing.

Methodology

LM sought submissions from landscape companies in the magazine, on LandscapeManagement.net, via email and over the phone from January through May. Companies submitted their details through an online form. LM editors compiled the results and, where applicable, removed nontypical green industry revenue sources from totals reported by companies. For example, we omit revenue from pest control and janitorial services.

We estimated revenue for firms that didn’t provide data if they participated in last year’s list and reported a projected 2016 revenue figure. We also calculated the numbers for client mix, profit centers and regional charts based on the data submitted.

Who’s missing?

Should your company be on the LM150 list of the largest landscape companies? Or do you know of any we missed? Contact Editor Marisa Palmieri at mpalmieri@northcoastmedia.net to be notified in early 2018 when the submission period opens. We encourage companies with $5 million-plus in annual revenue to enter.