Is your financial reporting system costing you money? Many managers ignore reporting and rely on preconceived beliefs. Sloppy reporting combined with conventional wisdom leads to poor decision making.

Even when I demonstrate reality, many managers refuse to believe me. They say, “I make no money in maintenance; I make my profit on extras.” This scenario is rarely true. Or, “I make a lot of money in snow.” Maybe you did 10 years ago but not today.

Conventional wisdom married to sloppy reporting perpetuates these misconceptions. If not for management, how else do we explain that median industry net profit levels have declined over the past 10 years? It’s a widespread situation that I’ll address in my next few columns.

Once upon a time, sloppy reporting didn’t matter as much. There was more innate profit available in the landscape business. Now, that’s not the case. There are more landscapers, customers pay less and costs are higher. There is less room for monetary mistakes. Good information costs money whether it’s spent on staffing or software. Yet, less has been invested in this task as overhead spending (seen as the net profit culprit) has been slashed over the past few years. The truth is, falling gross profits are the real culprit, and it’s here—where reporting is sloppiest—where the real action takes place.

Outsiders think landscape management is a simple business. It’s not. There are more moving parts than in almost any industry. Numerous combinations of services, weather, people and deliverables make it difficult to track “the numbers” with consistency. Sloppy reporting is, to some degree, the “nature of the beast.”

Causes, solutions

Causes, solutions

Aside from the nature of the beast there are two causes: 1). lack of agreement on what exactly is the “correct” form for reporting, and 2). improper methods (processes and responsibilities) for processing, reviewing and presenting information. In simplest terms, we don’t agree on the definition of gross profit or how to account for costs of goods. We don’t agree on what is “included” in revenue and cost of goods and when it should be “included.” Sure, everything might wash clean in the year-end financials, but what about the other 364 days when money is being made or lost?

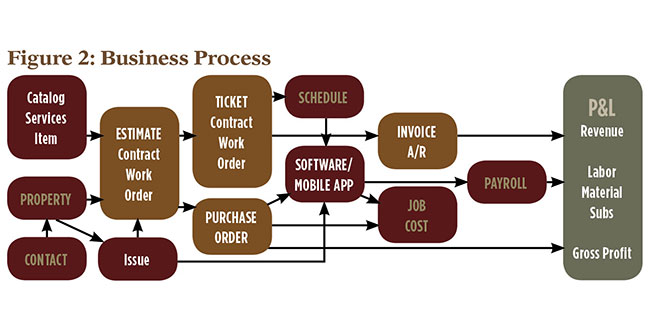

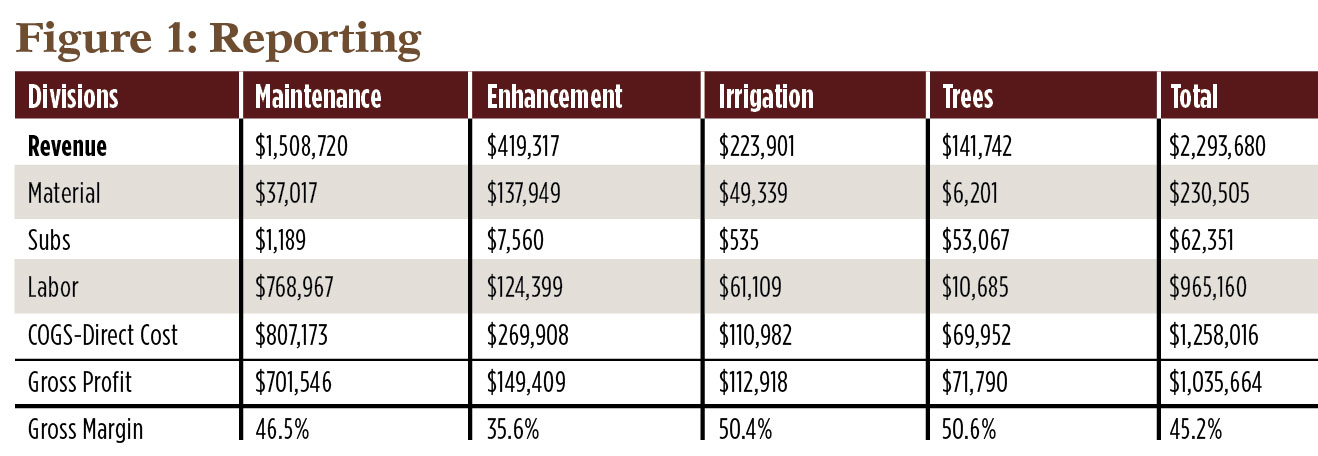

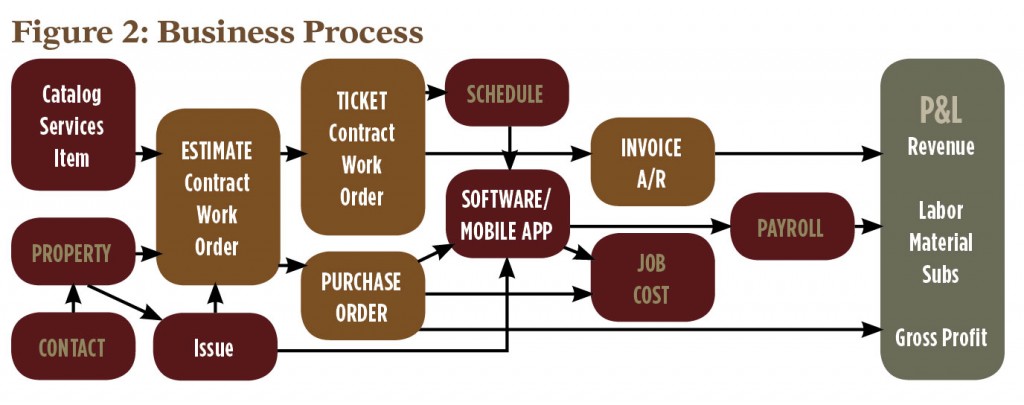

We need agreed upon operational and financial reports and a system of processing transactions that addresses the amazing number of combinations and permutations of services, weather, people and deliverables. At the heart of this system are a few key concepts: reporting (Figure 1) and business process (Figure 2).

We need agreed upon operational and financial reports and a system of processing transactions that addresses the amazing number of combinations and permutations of services, weather, people and deliverables. At the heart of this system are a few key concepts: reporting (Figure 1) and business process (Figure 2).

Reporting defines gross profit. Business process defines the steps in processing, reviewing and presenting transactional information. The key business process concepts are: 1). estimate (whether it’s a recurring contract services or a one-time service), 2). ticket (permission and budget to deliver services), 3). purchase order (permission to buy or allocate materials), and 4). invoice. All the rest are activities in the flow of managing these key concepts. So whether you spend money on software or people to get this right, you spend it wisely because the cost associated with mismanaging gross profit far outweighs the overhead associated with proper reporting.

In May, I’ll cover the definition of gross profit and cost of goods for proper reporting.