2020 will always be remembered as a year of uncertainty, but at least one thing remained the same: The lawn care and landscape industry continued to grow and set records.

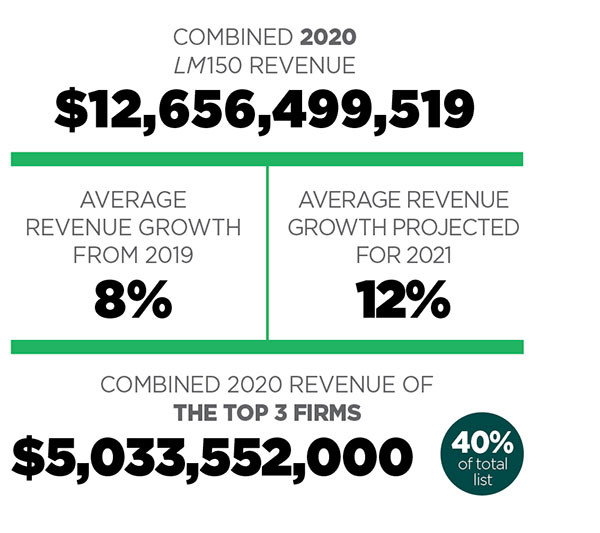

The total revenue in the LM150 list, sponsored by Aspire Software, once again set a record at $12.6 billion. That’s up $400 million from last year. The top three companies remain unchanged from last year: BrightView Holdings, TruGreen and The Davey Tree Expert Co. Yellowstone Landscape, based in Bunnell, Fla., saw a 34 percent increase in revenue and jumped up one spot to No. 4 on the list. Bartlett Tree Experts rounds out the top five companies.

A common theme we saw this year in the submissions was companies writing to us about how important a strong company culture was in uncertain times. While “the new normal” was a common theme in 2020, at companies with strong cultures, employees felt normal and safe at their workplace. That’s why we profiled three companies that pride themselves on having strong company cultures: GreenScapes Landscape Co., Columbus, Ohio; Ryan Lawn & Tree in Kansas, Missouri and Oklahoma; and Caretaker Landscape & Tree Management, Gilbert, Ariz.

Companies on the LM150 list certainly rose to the challenges provided by 2020. As Mark Wordley, COO and president of Caretaker, told LM, “Generally, in businesses, you’re planning at least a year out. The uncertainty from month to month meant that we needed to be very nimble.”

Methodology

LM sought submissions from landscape companies in the magazine, on LandscapeManagement.net, via email and over the phone from January through May. Companies submitted their details through an online form. LM editors compiled the results and, where applicable, removed nontypical green industry revenue sources from totals reported by companies. For example, we omit revenue from pest and janitorial services.

We estimated revenue for firms that didn’t provide data if they participated in last year’s list and reported a projected 2020 revenue figure. We calculated the numbers for client mix, profit centers and regional charts based on data submitted.

The information in the LM150 is self-reported unless otherwise noted. Some companies do not break out individual service lines, so we can’t be sure what revenue is specific to typical green industry services. Several firms opt not to participate in the list, there are others we are unaware of and it is possible some revenues overlap due to subcontracting agreements.

Fear of being left out?

Should your company be on the LM150 list of the largest landscape companies? Or, do you know of one that should be on the list, but isn’t? Contact Special Project Editor Marisa Palmieri at mpalmieri@northcoastmedia.net to be notified next year when the submission period opens. We encourage companies that think they might make the list to contact us for information.